charitable gift annuity minimum age

Ad Earn Lifetime Income Tax Savings. The minimum gift amount is 50000.

Charitable Gift Annuities Barnabas Foundation

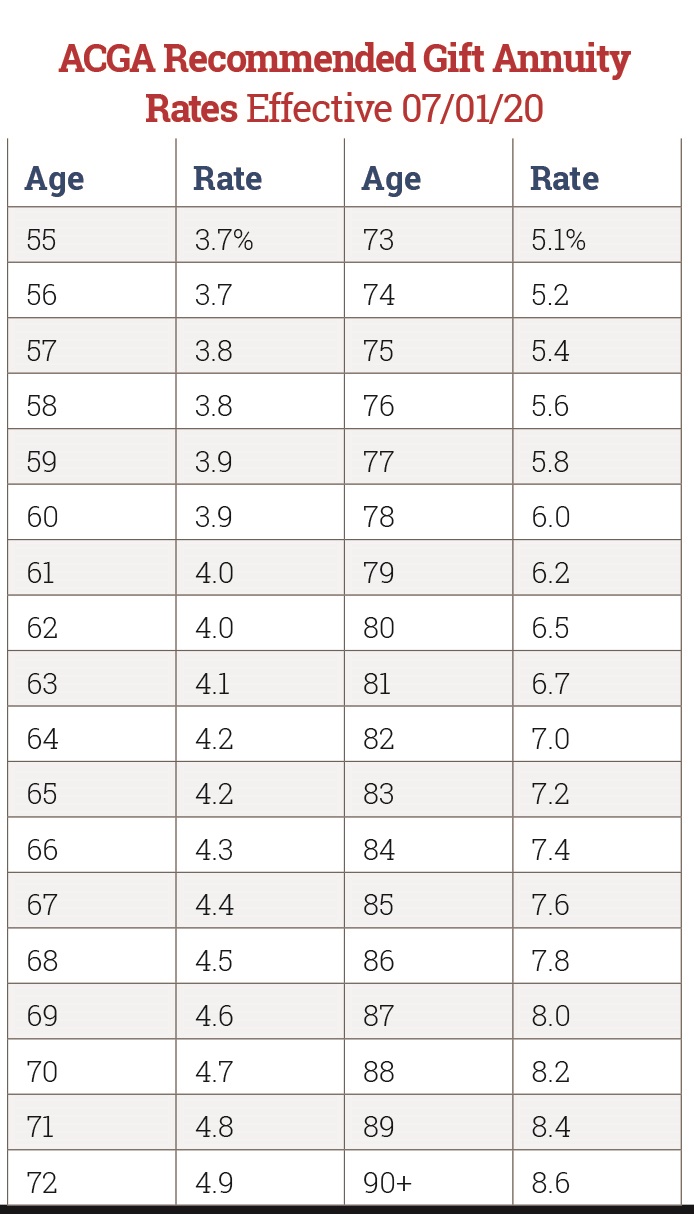

Up to 25 cash back At age 65 the rate is 47 and at age 70 it goes up to 51.

. Ad Support our mission while your HSUS charitable gift annuity earns you income. Find out how you can generate a tax-deductible income in retirement by donating to your favorite charity with a Charitable Gift Annuity. The minimum gift is 10000 and the minimum age when payments may begin is 55.

Do Your Investments Align with Your Goals. Is a Humane Society gift annuity the right choice for you. What is the minimum age and amount required to establish a Charitable Gift Annuity with ChildFund and begin receiving payments.

Give Gain With CMC. Learn how to maximize your impact with a Schwab Charitable donor-advised fund. Ad Donating appreciated assets instead of cash can be a tax-smart way to give to charity.

Many states that regulate charitable gift annuities require the charity to supply the state with the charitys published gift annuity rate chart of the maximum annuity rates the. When you die alongside your spouse if you gave us a. Is a Humane Society gift annuity the right choice for you.

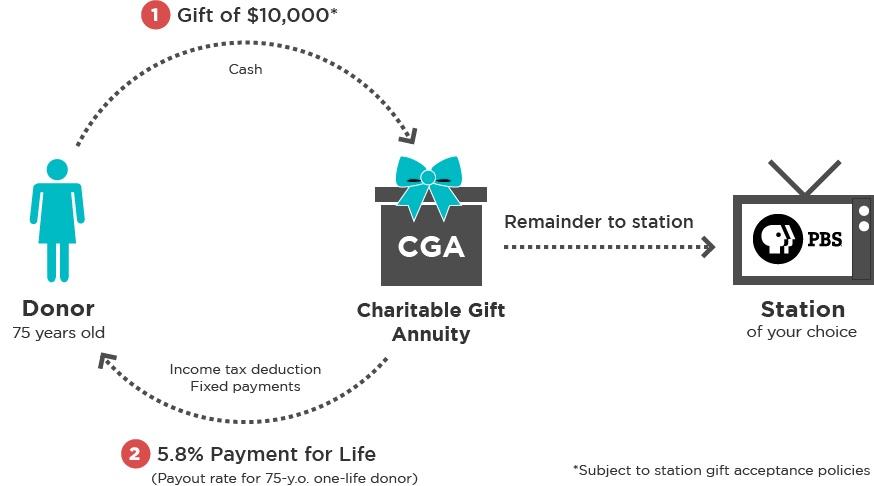

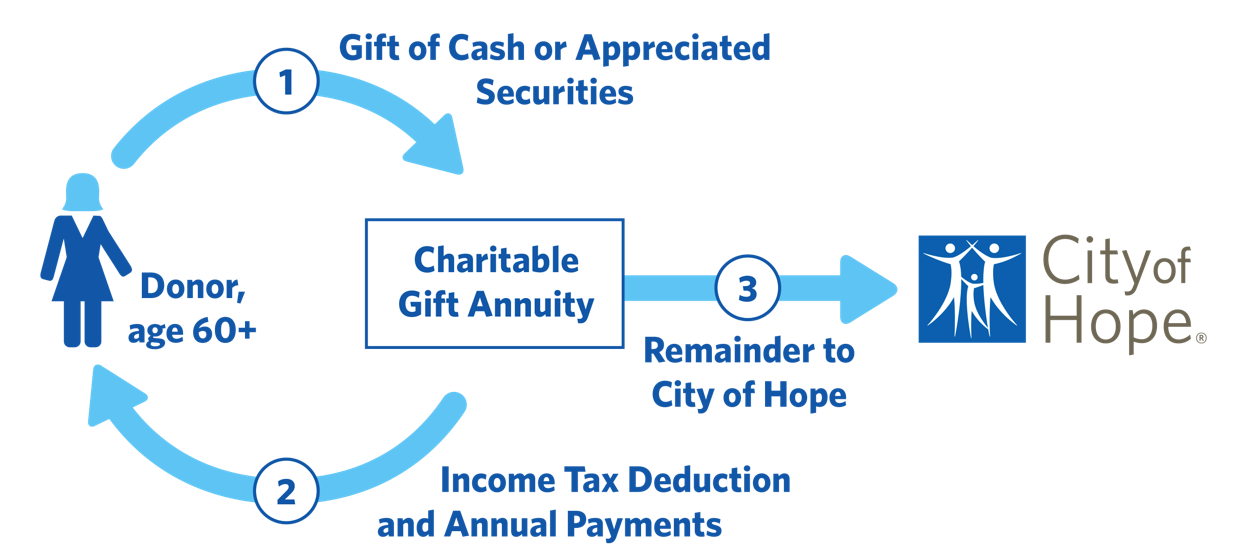

Charitable Gift Annuities. When you establish a charitable gift annuity by gifting cash or stock to Child Evangelism Fellowship you will receive an immediate tax. For example if you created a 100000 gift annuity at age 70 you could expect to receive 4700 in payments each year.

Current gift annuity rates are 49 for donors age 60 6 for donors age. Minimum gifts for establishing a charitable gift annuity may be as low as 5000 but are often much larger. Creating a charitable gift annuity.

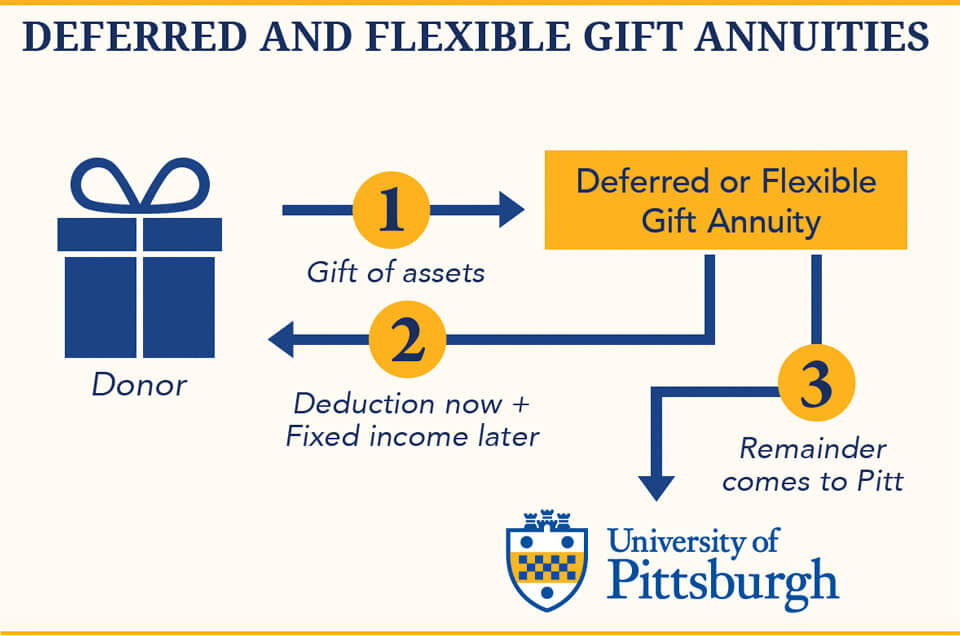

The payment rate for joint gift annuities is lower than the rate. Find a Dedicated Financial Advisor Now. If the annuity is deferred it is recommended that the minimum age of the annuitant at the time payments begin be the same as the minimum age of an annuitant of an.

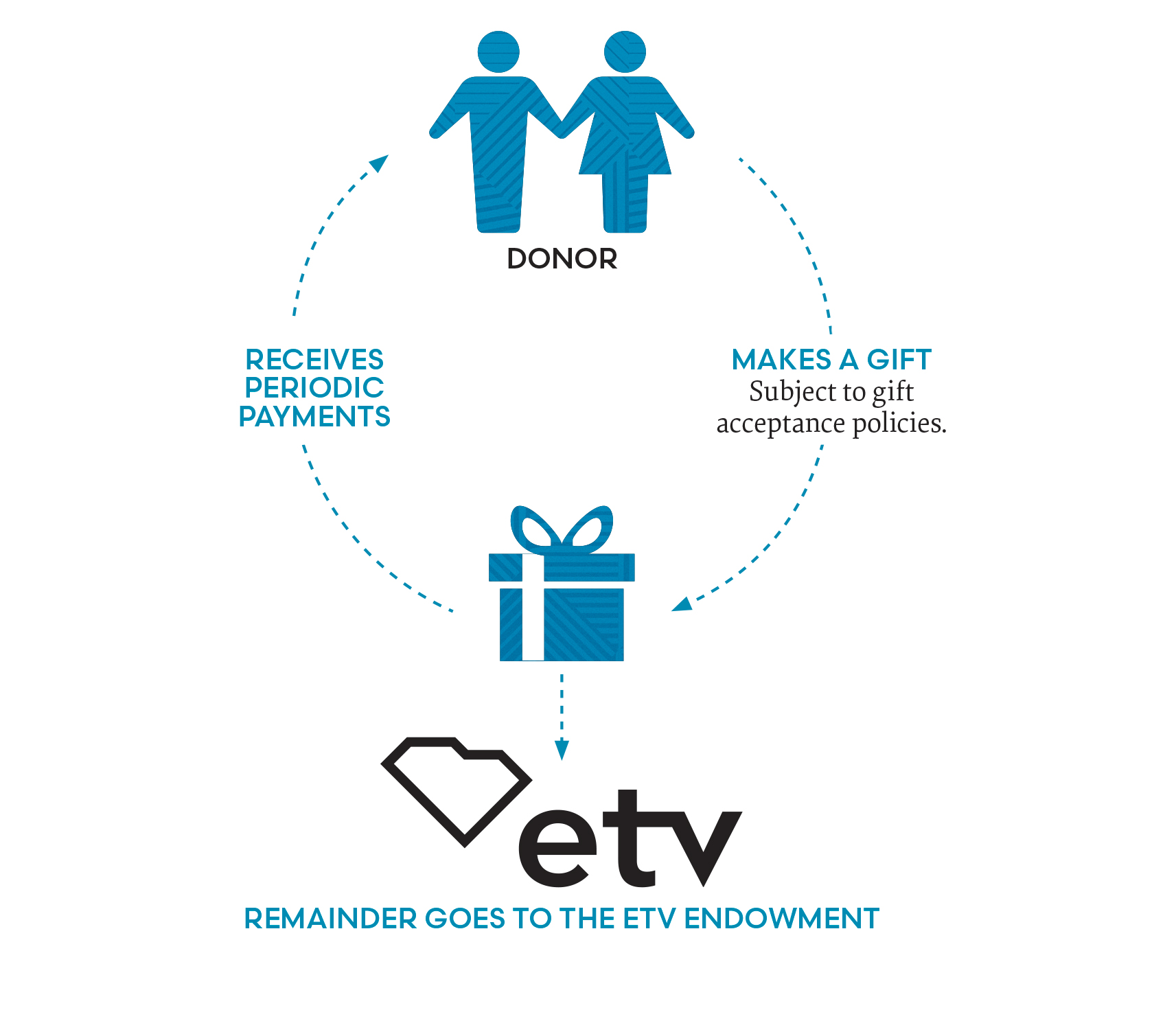

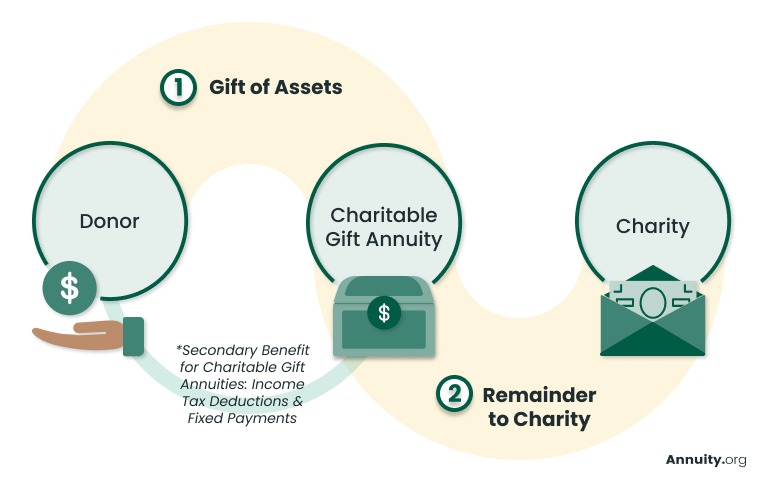

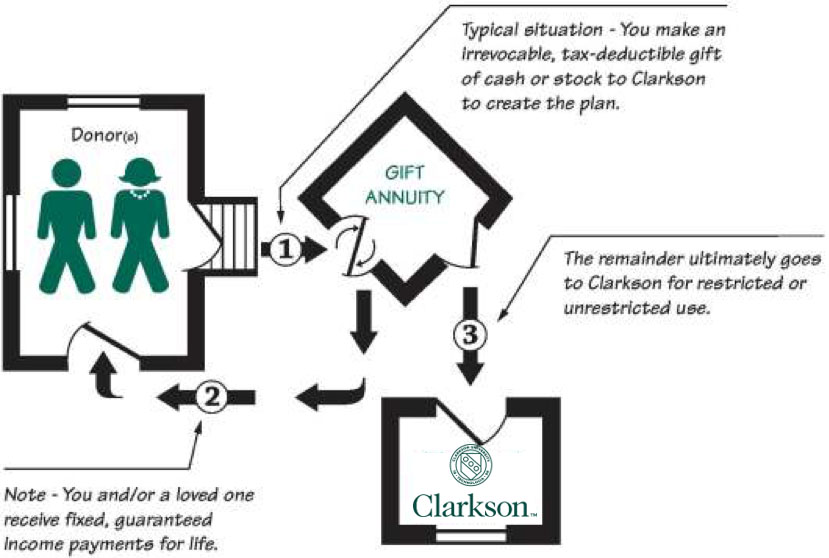

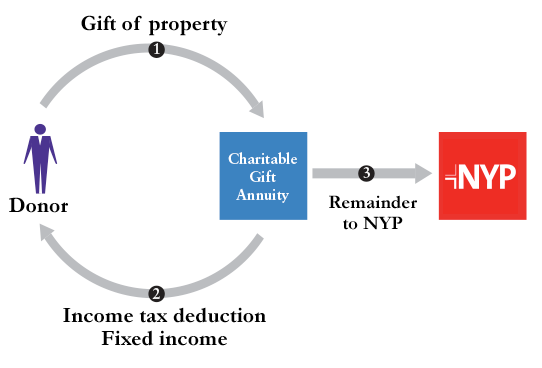

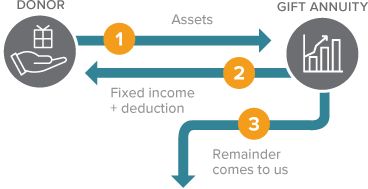

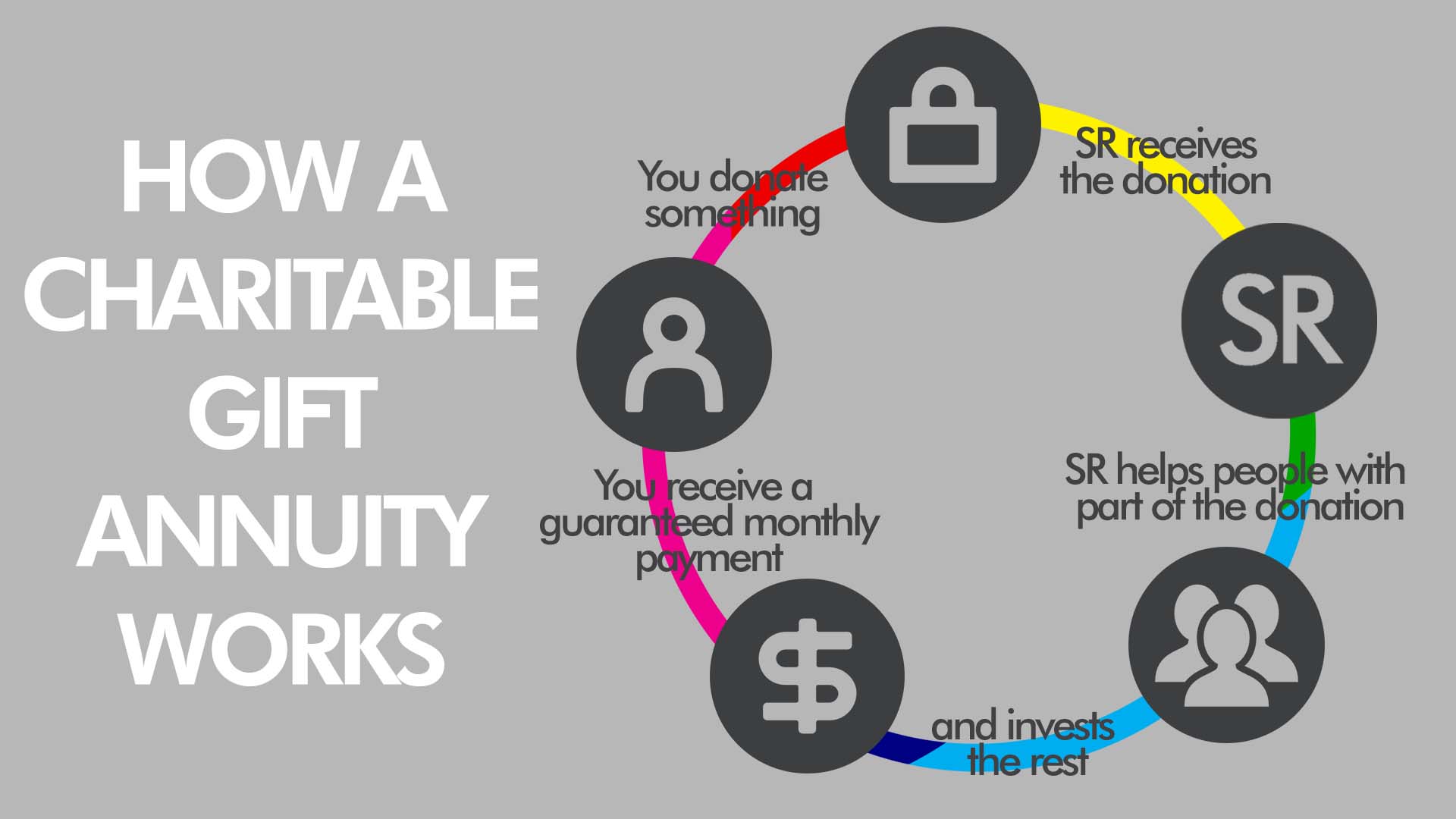

Understanding a Charitable Gift Annuity. Charitable gift annuities make this possible. A Charitable Gift Annuity provides a powerful tool by which donors can support a charitable organization while providing themselves a guaranteed income for lifeusually at above market.

You will incur no costs to establish the arrangement and no. The minimum age for an AACR Foundation gift annuity is 60. A charitable gift annuity CGA is an arrangement whereby assets are given to a charity in return for the charitys promise to make lifetime payments of a fixed amount to a.

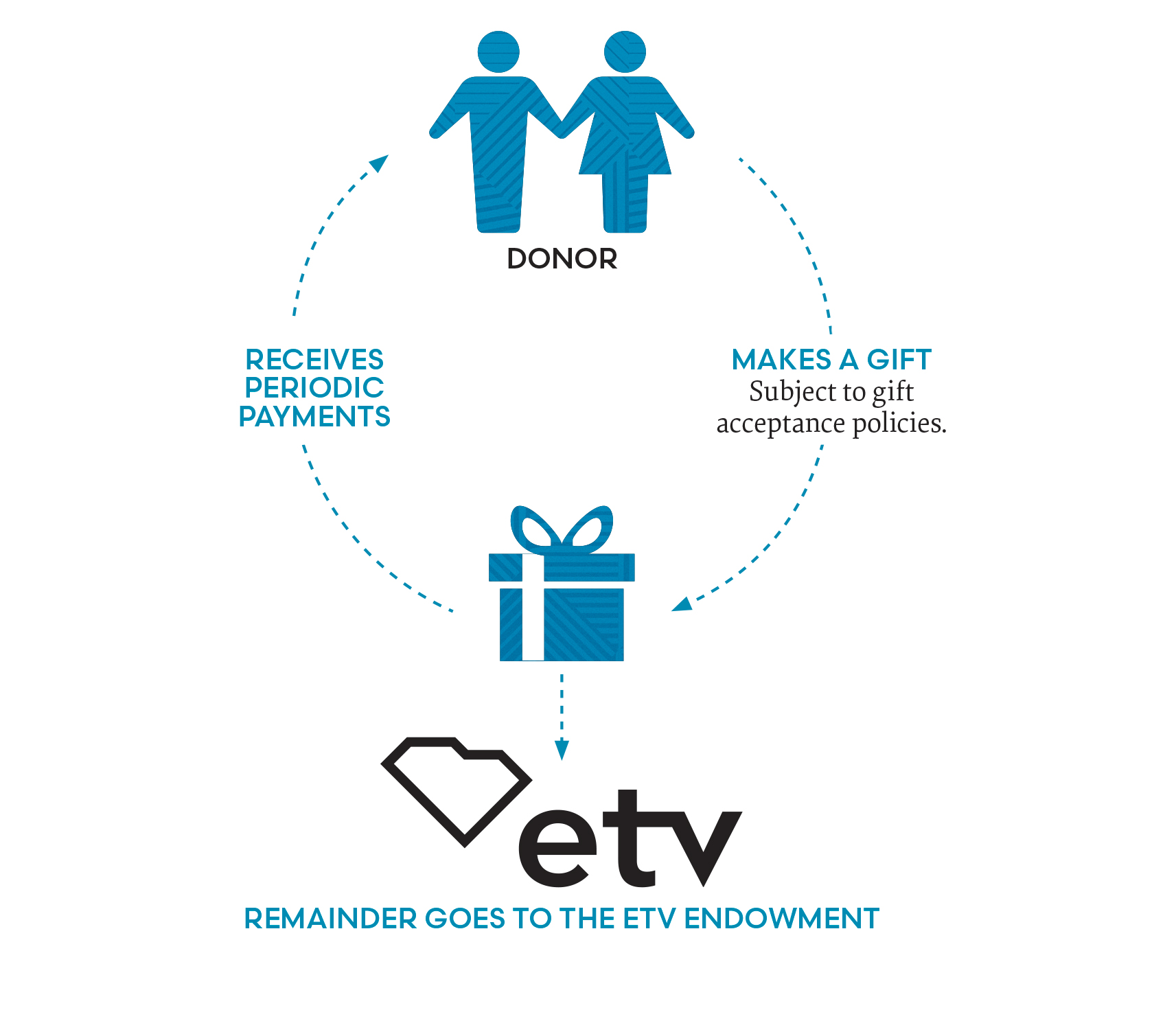

If you and your spouse create a gift annuity together the rate is based on your combined statistical life. A charitable gift annuity is a contract between a donor and a qualified charity in which the donor makes a gift to the charity. Learn about charitable gift annuities the pros cons of this type of monthly payment for donors how they work in terms of taxation regulations.

Including your ages when you set up the charitable gift annuity. The amount of your payments is based on your age. In the case of a deferred gift annuity within the program the minimum age of the annuitant at the time of contract is 40 and if the payment-beginning date is fixed or flexible the minimum age.

New Look At Your Financial Strategy. The minimum age to establish a CGA with the AACR is 60 and the minimum gift amount is 50000. The minimum amount to start an annuity with CFNEK is 25000.

Visit The Official Edward Jones Site. Gift annuities may be funded with cash or securities. A charitable gift annuity CGA is a contract in which a charity in return for a transfer of assets such as say stocks or farmland agrees to pay a fixed amount of money to.

With your gift today you can pick a date1 year or more in the futurewhen youd. In exchange the charity assumes a legal obligation. Give Gain With CMC.

Income rates are based on your age or the age of your beneficiary at the time payments commence. Establish guidelines for gift minimums such as 10000 or higher for a CGA and approve subsequent gift annuities by a repeat donor at a lower minimum such as 5000. Ad Support our mission while your HSUS charitable gift annuity earns you income.

When you establish a charitable gift annuity with the Oblate Annuity Trust minimum 5000 you will receive annual fixed payments for the rest of. A charitable gift annuity is a simple arrangement between you and Pomona College that requires a one or two page agreement. You must be 60-years-old to begin receiving.

The minimum age to establish a charitable gift annuity with the Catholic Foundation of Northeast Kansas is 65. A deferred gift annuity provides all the annuity benefits while providing an additional level of flexibility. What if I have not reached 60 years of age but have an interest in establishing a.

Ad Earn Lifetime Income Tax Savings. Charitable Gift Annuity Immediate University Of Virginia School Of Law The age for RMDs would initially increase to 73 starting on January 1 2023 then to age 74 on January 1. In addition to a lifelong annuity and an immediate tax deduction other benefits of.

Judging by your age and when you gave the gift there is a fixed payout monthly or quarterly.

Charitable Gift Annuities The University Of Pittsburgh

Charitable Gift Annuities Uses Selling Regulations

Charitable Gift Annuities Development Alumni Relations

Charitable Gift Annuity Immediate University Of Virginia School Of Law

Charitable Gift Annuities Giving To Stanford

Nyp Giving Planned Giving Gifts That Provide Income Charitable Gift Annuity Nyp

Gifts That Pay You Income The Salvation Army Western Territory Arc

Charitable Gift Annuity The Als Association

Everything You Need To Know About A Charitable Gift Annuity Due

Charitable Gift Annuities Suny Potsdam

Turn Your Generosity Into Lifetime Income The Los Angeles Jewish Home

Charitable Gift Annuities Uchicago Alumni Friends

Charitable Gift Annuities Studentreach

City Of Hope Planned Giving Annuity

Charitable Gift Annuity Etv Endowment Of South Carolina

Acga Announces New Suggested Charitable Gift Annuity Rates Sharpe Group